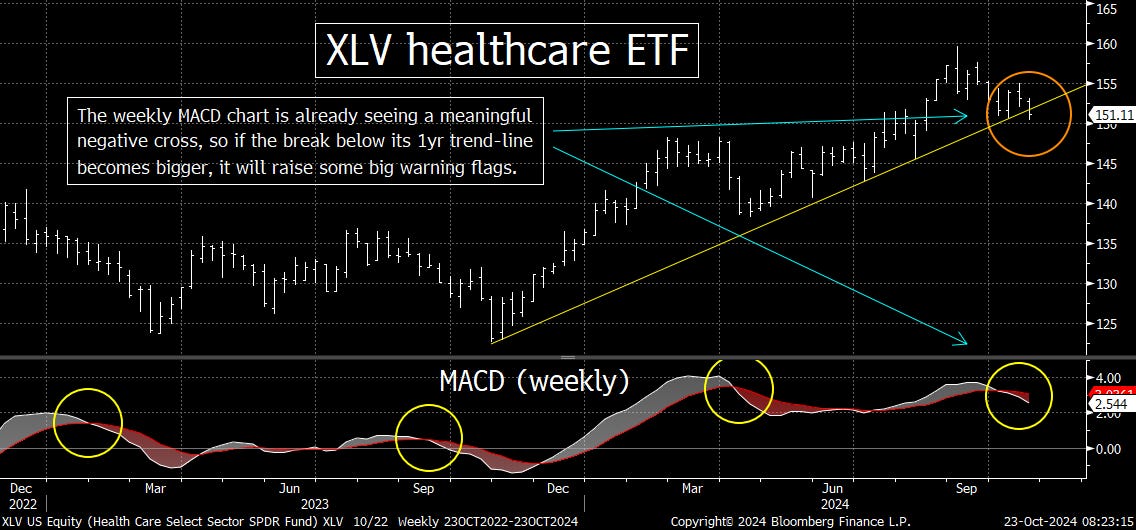

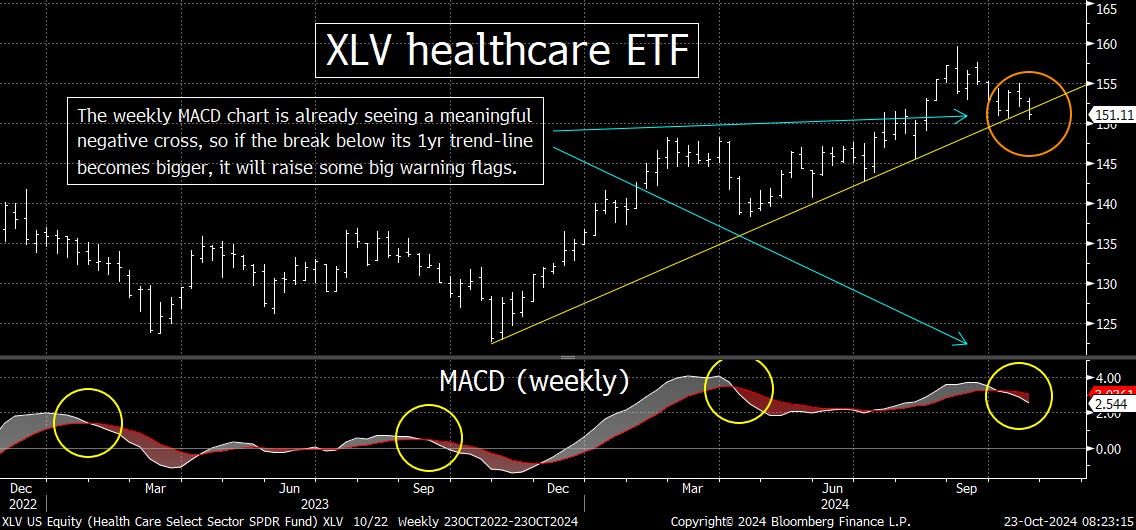

Cracks in the Rally of the Healthcare Stocks?

If the XLV healthcare stock ETF sees more downside follow-through, it's going to raise some warning flags.

The broad stock market has been a bit boring over the past several trading days. That could change…especially if the Treasury market and/or currency market see any kind of reversals soon (which is not out of the question).

The XLV healthcare stock ETF is seeing some cracks in its chart. So, if it sees much more downside follow-through, it will raise some warning flags on this sector.

For the third day in a row…and for the 4th day in 5…the stock market traded in an extremely tight range yesterday. The S&P 500 saw a very mild drop…with the NDX Nasdaq 100 seeing a similarly mild gain…on volume that continues to be very low for both. Does this mean that the stock market is coiling up of a big move in one direction or the other? That’s hard to say…but with an upcoming strike by Israel on Iran a certainty…we could have a big move at some point soon…….That said, the US election is still two weeks away…and if (repeat, if) Israel has agreed to push any response until after the election…the broad market could be stuck in a range for a while longer. (We’d hate to see what the response in the market will be if that “response” takes place with a repeat of the 2000 election…when nobody knew who won for well over a month.)

However, there will be plenty of volatility for some of the individual stocks who report earnings…or have other new-news that becomes available. This morning, McDonalds (MCD) is trading lower by 6% on an E. Coli scare…and Qualcomm (QCOM) is down 3.5% on news that ARM is scrapping their chip design license with the company. Coca Cola (KO)is trading lower on their earnings…which including lower volumes…..Tonight, we get Tesla’s (TSLA) earnings could/should have a big impact on that stock…and we get the numbers out of IBM, UPS, AAL, HON, NEM, and LRCX before the week is over.

We are not trying to say that there is little chance that the broad market will see a discernable move until we see the level of response from Israel…or the results of the US election. We’re just saying that a lot of investors seem to be sitting on their hands right now. There are plenty of other issues that could have an impact on the market. Treasury yields keep pushing higher…with the 10yr note not above 4.2%, so that is starting to create some headwinds for the stock market. However, the yen continues to weaken quite significantly (especially this morning), so this is helping buoy the market…with the added liquidity from the “carry trade.”

It is important to note that the yen is becoming quite oversold right now…with the USDJPY becoming overbought. The USDJPY has not become as overbought as it was at the highs of April and July…so it could rise further (lower yen) over the very near-term. Also, this currency-cross has broken above its 200-DMA, so it could certainly push higher this week. However, since it’s overbought, it’s getting ripe for a reversal soon…which could/should bring a pickup in volatility in the stock market along with it.

In other words, even though the past week or so has been relatively uneventful in the broad stock market, we could still get some excitement in one direction or the other before too long…..Not only is the yen getting oversold, but the TLT Treasury ETF is also oversold once again…so a meaningful reversal in either one of these could cause the recent boredom to disappear very quickly. (USDJPY & TLT charts are the first two below.)

There is one area that we have been bullish on that is seeing some cracks. We’re talking about the healthcare stocks. As the S&P 500 has bounced quite nicely (to a new record highs) from its early September lows, the XLV healthcare ETF has declined almost 4%. Of course, a 4% drop is not a significant one, so we’re not sending up any major warning flags. However, this drop has been enough to take the XLV down to its trend-line going all the way back to the October lows of last year. Actually, it has fallen slightly below that trend-line…and it has also seen a fairly meaningful negative cross on its MACD chart. The last few times that it has seen a negative “cross” like this, it has been followed by some further material weakness.

We do acknowledge that some of this weakness can be attributed to one stock. United Health (UNH) got hit quite hard after the reported earnings recently…and it is 9.5% of the XLV. However, other stocks have been drifting lower since Labor Day…like Eli Lilly (LLY), JNJ, AbbVie (ABBV) have all moved lower over the past two months…and Merck (MRK) has been hit quite hard (after already falling in a significant way over the summer). So, you can see that the action in the XLV cannot be blamed on just a very small number of stocks.

As always, we’ll have to see more downside follow-through…and a more substantial break below its 1-year trend-line before we would reverse our bullish stance on this defensive group. However, some cracks are definitely showing up in the chart of the XLV, so it’s something we’ll be watching very closely over the coming days and weeks. (XLV is the 3rd chart below.)