Go Colby, Beat Bowdoin!!!

This Weekend's Football Game is Life or Death for the Markets!!!

We’re sorry, but there in very little question that most people do not understand how the markets work. In fact, many of them don’t know how the world works!.....They have no idea what really drives the markets…and what really drive society today…….If they only understood that the results of a Division III football game that will be played in Waterville, Maine this weekend…is the most important issue facing the markets AND the world right now…they’d be much, much better off!

The stock market bounced back very nicely yesterday…helped by a strong rebound in the tech sector and a 4% jump in Bitcoin. The volume was lower that it was on Tuesday in the SPY…and it was quite a bit lower on the QQQ. So that was somewhat disappointing. We’d also note that the breadth was mixed. The advancers vs. decliners were just 3 to 2 positive for the S&P 500…and not even 2 to 1 positive on the NDX 100. However, 10 out of the 11 S&P 500 groups finished in the green, so the advance was still a little broader than it was during last week’s bounces…..We’d also note that Advanced Micro (AMD) was able to bounce nicely off its lower opening…and finish nicely in the green. So, it did not see the kind of “sell the news” reaction it looked like it was going to be before the opening.

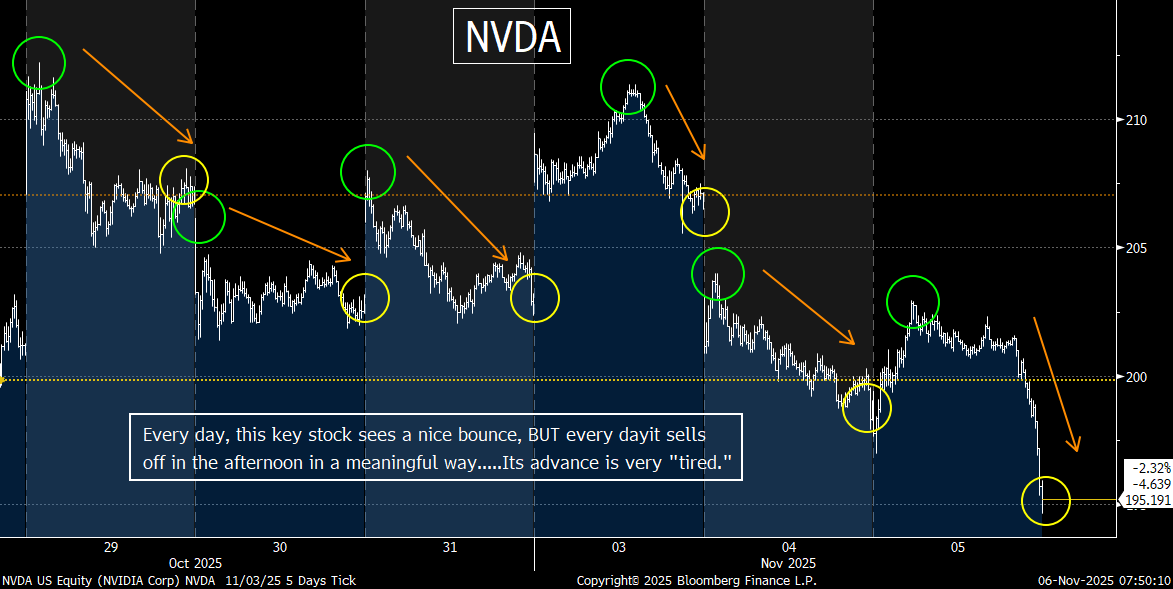

If there was one item that was disappointing from yesterday’s action was that the market saw a rather steep decline in the last 30-45 minutes of the day. As we highlighted yesterday, this is something which has been taking place every day for over a week now. This new trend is quite different than we’ve been seeing for most of the past six months. In fact, just the opposite had been the norm. So, the fact that these late-day sell-offs continue to be the norm…tells us that this rally is indeed getting tired…as we still believe that a near-term pullback in the stock market is likely…even if the market is headed higher over the intermediate-term…….(Also, as you can see from the updated chart below from Monday, the exact same thing is taking place in the most important stock in the market…Nvidia.)

That said, stocks were able to advance yesterday in the face of higher long-term interest rates. The yield on the 10yr note is still below the 4.2% level we cited over the weekend as one which could create some headwinds for stocks…and they’ve moved a bit lower this morning. Also, these yields are pushing higher because the private economic data we’re getting is positive. Thus, that bodes well for earnings. However, it also raises some questions about just how accommodative the Fed will be over the next several months. In other words, maybe the less dovish comments from Chairman Powell and other FOMC members were not just some rhetoric they used to throw some cold water on the froth in the marketplace. Maybe they are indeed going to be slower in cutting rates over the coming months.

Of course, there are plenty of other issues which could impact the markets as we move towards Thanksgiving. The government shutdown is obviously one issue. There are a lot of voters who are going to be REALLY ticked off if the Thanksgiving travel period is a lot worse than it usually is (thankfully, we’re not traveling). So, we still think they’ll get things settle by then…especially since we’ve moved past Election Day. (Any kind of passenger aircraft disaster during the shutdown could be catastrophic.) However, since the shutdown has not had a negative effect on the markets, we’re not so sure that an agreement in DC will create more than a one-day bump (and it might not get any bump).

Then there is the Supreme Court decision on the Administration’s tariffs. Based on the questions that were asked by the Justices yesterday, the experts fell that their ruling might not be favorable for the Administration, but we probably won’t get the ruling until at least mid-December. Thus, this is something that won’t have an impact immediately. However, we thought it was very interesting that in an interview this week, Secretary Bessent spent a lot more time arguing that the Supreme Court usually doesn’t rule against a new Administration’s most important policies. (He used the Obamacare example from a dozen years ago.) In other words, Mr. Bessent spent more time using that argument…than the legal issues involved in this debate. So, it seems to us like they know that a ruling against them is likely…….Since they have a lot of options at their disposal if it is rejected by the Court, a negative ruling won’t be a major setback…but it will still create some real uncertainty.

Over the nearer-term, we still have more earnings to sift through…a decision from Tesla on Elon Musk’s pay package…a rising level of high-profile layoffs…and a war in Eastern Europe. However, we still believe that the action in Bitcoin will continue to be a key indicator for how the stock market acts over the short-term. The correlation between this cryptocurrency and the stock market has been a strong one for some time now, but it has been particularly strong recently. So, this is something we’ll continue to watch very closely.

Having said all this, the most important development for the markets over the very-near-term is something we highlighted in our weekend piece…and we want to reiterate it again this morning. There is NOTHING more important IN THE WORLD for the markets going forward…than the results of a football game that will be played in Waterville, Maine on Saturday!!! Not only is the CBB Title on the line, but Colby could finish in SECOND place in the NESCAC (New England Small College Athletic Conference) for the first time since God was a child for crying out loud!......This is HUGE!!!!......In fact, it’s life or death!!!!!

Go Colby, beat Bowdoin!!!!!!