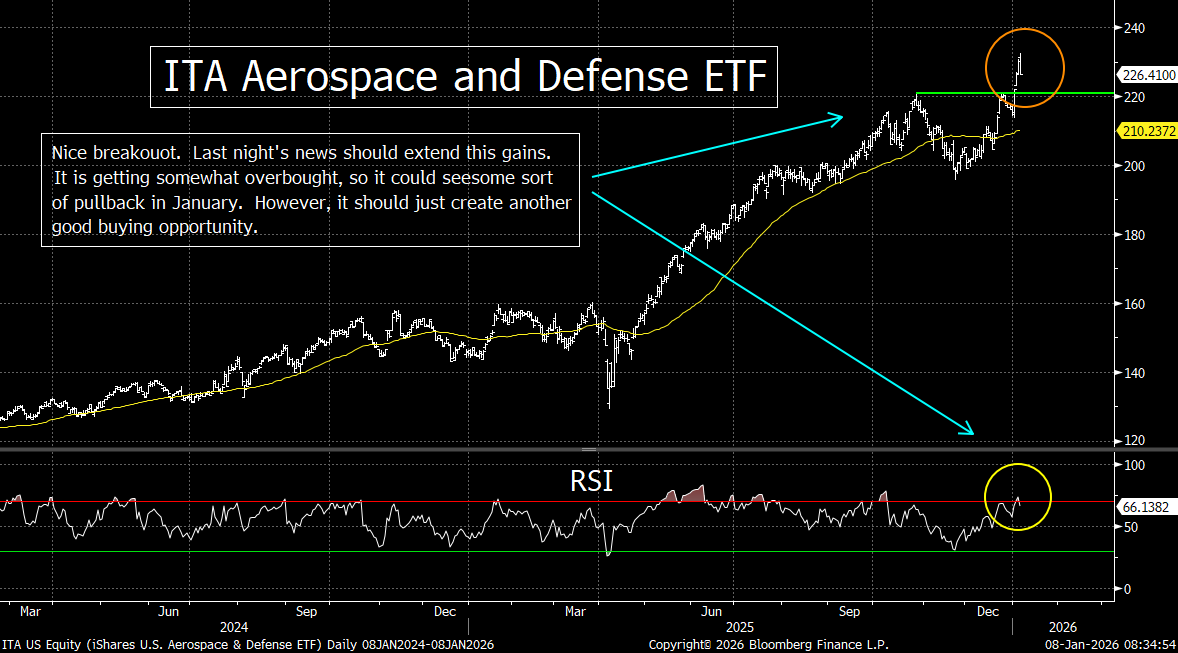

The Aerospace and Defense Industry is getting somewhat overbought near-term. So, it could/should see some sort of pullback as we move through the month of January. However, we believe that will provide just another good buying opportunity. The world is not getting any safer.

Due to the overwhelmingly positive response to our live meetings in December, we’re going to revive them…starting next week. We’re going to do them on Wednesdays at noon……Please lookout for more details later this week and early next week!

A rather boring day in the stock market…became a very interesting one…quite quickly yesterday afternoon……..As investors were sitting on their hands waiting for Friday’s employment report, the White House came out with several announcements which created some stark volatility in certain sectors of the market.

First, they announced that Venezuela would turn over about 50 million barrels of oil to the US…which knocked down the energy sector in a material way. Then, they floated a plan that would stop institutional investors from buying single-family homes…which hit the private equity firms and the homebuilders meaningfully. Finally, the President tweeted plans to prevent defense industry contractors from paying dividends and engaging in buybacks…which knocked down the aerospace and defense stocks.

The decline in these sectors led to a pullback in the broad stock market. The drop was not a big one…and it came after a nice three-day run to start the year. So, it was not something that created much fear among investors……..The futures are trading a bit lower this morning, after the nice jump to start the year off, it’s not something that is creating any significant angst in the marketplace. So, the focus still remains on tomorrow’s employment report. Thus, unless we get some more news from the White House, it could/should be an uneventful day for stocks today. (Of course, betting on nothing coming out of the White House is risky unto itself.)

However, the aerospace and defense stocks bounced back strongly. This came after President Trump stated that he wants to increase the defense budget by 50% (to $1.5 trillion) in fiscal 2027…..His comments about the defense industry are not conflicting…even though the group saw decidedly different reactions to each post. Any restriction on dividends and buybacks does not mean anything when it comes to how much the government will spend on defense. In other words, both CAN be true. However, these developments…along with other developments over the past year…confirm something we’ve been saying since before Mr. Trump returned to office: The world is not getting any safer…and the US defense industry (and the European defense industry for that matter) should benefit from this.

We’ve had the bombing of Iran’s nuclear capabilities…and now the developments in Venezuela. Also, there is little question that…based on the President’s first comments yesterday…he wants the defense industry to produce their armaments much more quickly. Based on his second comment…he also wants to increase military spending in a substantial fashion…..Heck, they even changed the name of the Department of Defense…to the Department of War!

We realize that the President asks for a lot…and then expects to get something smaller than his original request…in the end. That’s his style of negotiation. We also realize that he loves the “quick strike” options…rather than something which is drawn out (at all). So, we’re not trying to portray him as a “war president.” Instead, it seems much more like he wants to be like Teddy Roosevelt. (“Speak softly and carry a big stick”…..However, in his case, it’s “Speak LOUDLY and carry a big stick.”)…….Either way, these defense contractors should do well going forward.

The ITA Aerospace and Defense ETF responded to the first bit of news from the White House, but did not respond to the second bit of news…because the market had already closed when it was made. So, it is bouncing back quite nicely this morning. That said…and even though we are very bullish on this sector over the intermediate and long-term, the ITA is getting overbought on a near-term basis. With yesterday’s news, we do expect it to rally further over the very-short-term, but it should be getting due for some sort of pullback…at some point in January. If it does, we think that it will likely be a relatively shallow dip…and that it will present another great buying opportunity for the defense stocks.