The Tech Sector Just Got Hit with the Second Part of a One-Two Punch

It had become quite evident during the past earnings season that the earnings growth from the AI phenomenon (outside the chip group) is not going to be as fast as investors had been hoping.

What a start to the month of September! It’s historically the worst month of the year…and the stock market sure had the kind of day that put some fear back into the marketplace. Of course, “one day” does not make a trend, but yesterday’s decline was definitely a rough one for equity investors. The decline began over some concerns that the bounce in the dollar might recreate some of the unwinding of the carry trade that we saw at the end of the summer swoon in early August. However, the drop accelerated quickly and significantly…when the decline in the tech group turned into an avalanche.

The decline took the S&P 500 lower by more than 2%...and both the NDX Nasdaq 100 and the Russell 2000 down by more than 3%! The drop came on much higher volume than the average volume we saw over the past 3+ weeks…when the market was bouncing so strongly off its early August lows…especially for the (QQQ NDX 100 ETF). That said, the breadth was not all that bad. It was 2.4 to 1 negative for the SPX and 3.3 to 1 negative for the NDX. Those certainly aren’t good numbers, but there not anywhere near as bad as we usually see when the indices fall as much as they did yesterday…and thus not as bad as we saw during much of the mid-July/early August drop in the stock market. However, it was still a relatively broad decline…as only one of the 11 S&P 500 groups finished the day in positive territory (consumer staples) and several fell by more than 2%.

However, it was the tech sector that saw most of the damage…as the XLK technology ETF dropped by 4.6% and the SMH semiconductor ETF fell by a whopping 7.5%!!! The chip stocks were led lower by the 9.5% drop in Nvidia’s shares (NVDA). As NVDA took a dive, stocks like Taiwan Semi (TSM), Advanced Micro (AMD), and Broadcom (AVGO) all fell more than 6% as well……We do need to note that the Justice Department sent subpoenas to the company (and several other chip makers)…accelerating its antitrust investigation. So, that could be seen as the main reason for the huge decline in the sector. However, that news came out AFTER these stocks had already been pummeled. (This makes us go hmmmmmm…and makes us think that somebody in authority should be asking Senator Howard Baker’s famous question from the 1970s.)

Anyway, the decline for the tech names outside of the chip group was not as rough, but stocks like Microsoft (MSFT) and Apple (AAPL) still fell by about 2%...and Alphabet’s 3.7% decline took it below its August lows and gave it a key “lower-low.” Therefore, there is little question that our stance strongly held belief that significant reversal in the tech group would create a decline for the broad stock market is the right one……We have been saying that the tech sector is just too highly weighted in the major averages for them not to send them lower if they rolled over in a significant way. Therefore, we said, any meaningful drop in the sector would stop the “rotation” trade…dead in its tracks. This was certainly the case yesterday.

The market is not getting much relief in pre-market trading…as both NVDA and the SMH semiconductor ETF are trading lower by well more than 1%. This is not a big surprise. First of all, NVDA was not the only company to be contacted by the DOJ. So, there are a number of companies who could face the kind of scrutiny that will bring into question whether they’re going to be able to maintain the kind of huge margins they’ve enjoyed for over a year now. Of course, this might help boost the margins for some others, but it does bring into question how strong…and how long…these incredible margins will remain going forward for the overall AI chip phenomenon.

This issue is particularly worrisome after the earnings season we just went through. It has become quite evident that the earnings growth from the AI phenomenon is not going to broaden out to the end users of the AI chips anywhere as quickly as analysts had been predicting for over a year. Not only had analysts been predicting a huge increase in earnings for the end users of these chips…but investors had been pricing in a big increase as well. Now that it is becoming clear that this is not going to come to fruition as quickly as the consensus had been thinking…AND that the AI chip makers themselves could be facing some compelling headwinds going forward….it’s going to be VERY tough for the tech sector to avoid a further decline over the near-term.

Of course, no market (or group, or stock) moves in a straight line. We could see a relief rally at any time. Broadcom (AVGO) reports tomorrow night…and that could give the group some relief. Besides, it’s not like the tech group is the only game in town. The employment report comes out Friday morning…and those reports are not known to be horrible ones two months before an election. (God help us if the data IS as bad as it was a month ago.)

So, maybe the thought that we’ll be able to achieve a soft landing will continue to help buoy the stock market for a while longer. However, the tech sector is STILL the most important game in town (even if it’s not the only game in town)…and if it becomes more and more evident that the AI phenomenon is not going to produce the kind of spectacular AND BROAD earnings gains the stock market is pricing in right now, this expensive stock market is going to face some serious problems at some point down the road. (That time could come a lot sooner than anybody is expecting.)

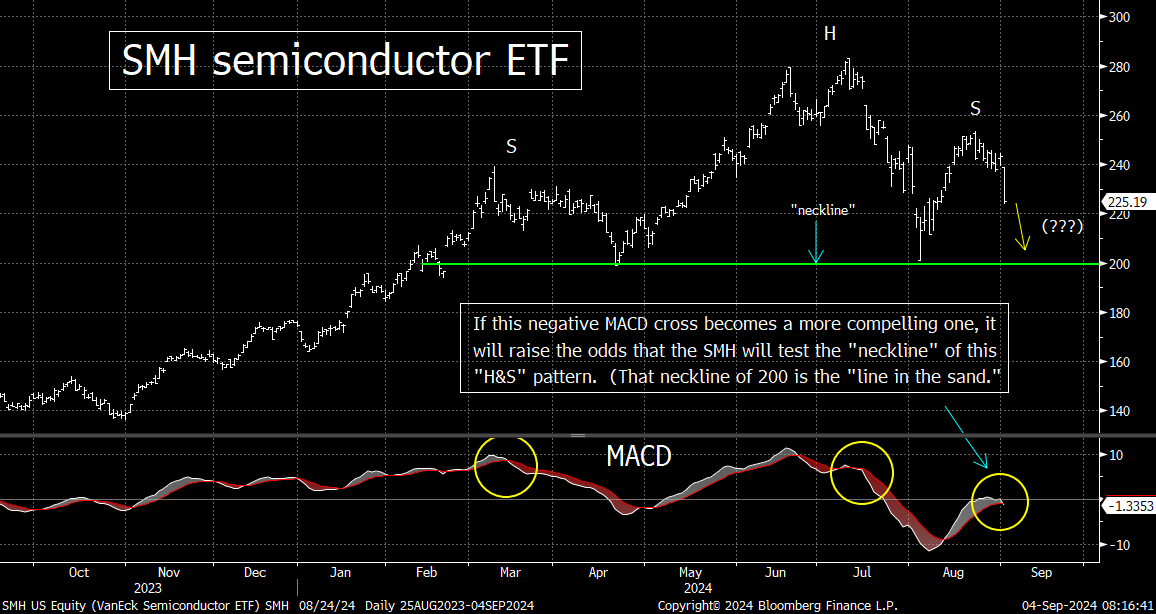

For us, the most important chart to keep an eye on will continue to be the one on the SMH semiconductor ETF. The first issue we’ll be watching is to see if the very slight negative MACD cross that took place yesterday…becomes a more compelling one. If that does indeed take place, the odds will become very high that the SMH is going to test its KEY support level of $200 (which is 10% below where it closed last night). That was the low from both April and August…AND it’s the “neckline” of a “head & shoulders” pattern.

Therefore, that $200 level on the SMH will be the second level to watch. That will be the “line in the sand” level for this key ETF. Of course, most investors will see level as a great buying opportunity…and it might indeed hold that level on its first try. In fact, it might indeed BE an unbelievable buying opportunity. HOWEVER, if (repeat, IF) the SMH breaks below that line in any meaningful way at any point over the next several months…it’s going to be incredibly negative for the chip group. Since the chip stocks have been the most important leadership group for the tech sector and the broad market for decades…a break below that 200 level would be back breaking in a very broad way.

Okay, we don’t want to suddenly become too negative, too quickly. As we said above, this week’s employment data could give us a lot of relief. Also, the tech sector might give bounce back very quickly…and avoid a negative MACD cross for the SMH. So, it is far from guaranteed that the SMH will even test that 200 level…much less break below it. Finally, election years are not ones where the market tends to fall out of bed just before Election Day.

However, we DO think that the news of the broader DOJ investigation of NVDA is quite serious…and it does raise questions about how long NVDA is going to be able to maintain their HUGE earnings growth. Since that could take place…at the same time that it has become evident that a big and quick broadening out of earnings from the AI phenomenon is not going to happen…there are some legitimate reasons to worry that the September/October timeframe could be a very rough one once again this year.