Crude Oil Testing a Key Resistance Level

The price of crude oil is very close to testing a level which, if broken, would be the first signal that the trend for the commodity is changing to the upside. That should be quite positive for the energy sector once again.

The stock market slid lower again yesterday…and thus the S&P 500 has certainly pulled back from the all-important resistance level we were harping on last weekend. (We’re talking about the 4,000 level…which is more than just a round number. It’s also very close to where while find both the 200-day moving average for the index…and its trend-line from the early 2022 all-time high.) The almost 2.5% decline we’ve seen since testing that level (-3.2% on an intraday basis) does not tell us a whole lot yet…but it should before too long.

What we’re saying is that the drop in the stock market we’ve seen this week is too much of a decline to be brushed off as just a very mild one…BUT it’s not big enough to declare that the nice rally we’ve experienced since the beginning of the year has already run its course…and is now reversing. In other words, if the stock market can bounce-back quickly, this week’s decline will be seen as just a blip on the radar screen…which was merely a normal “breather” in the middle of a nice advance. If, however, the decline continues soon, it will raise the odds that the 200-DMA has once again provided some serious resistance in the stock market…and we’re in for some very rough sledding over the rest of the first quarter.

The futures are pointing to a higher opening this morning, but we’re afraid that today might not be the best indicator of what we’re going to see next week. Today is the monthly expiration of options…and this particular one has the highest level of options that need to be rolled over in the month of January in more than a decade. In other words, even though it’s not a “quadruple witch” quarterly options expiration (which take place in March, June, September and December), it could still be one that gives us some wild moves. Therefore, it’s anybody’s guess which way the market will move today. With NFLX trading higher off better subscriber numbers and GOOGL trading higher on some cost cutting news (12,000 layoffs), the initial move should be to the upside. However, anything could happen after the opening…and thus we’ll be waiting until next week for the real clues as to whether the S&P 500 can finally break above its key resistance level…or it fails once again.

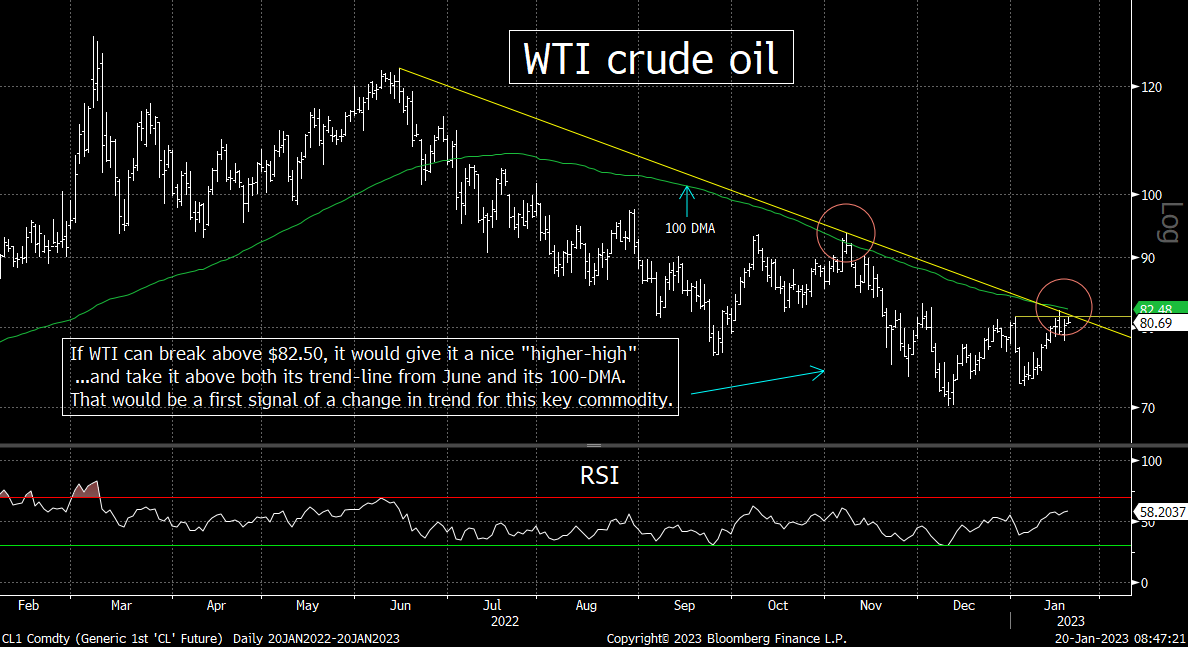

Speaking of key resistance levels, crude oil is also bumping up against one late this week. WTI is bumping up against its 100-DMA…which provided very tough resistance back in November…….The level we’ll be watching on crude oil is $82.50. If WTI can break above that level in a significant manner, it will take it above its 100-DMA (which provided tough resistance in November). More importantly a move above that level would ALSO push WTI above its trend-line from June…and give it a nice “higher-high” as well. Needless to say, that would be quite bullish for crude oil…as it would raise the odds that the downward trend in crude oil that we’ve seen for more than 6 months has been reversed.

That said, we do need to point out that it will take a break above the October/November highs of $93 to confirm a change in trend, but a move above $82.50 would be a very nice start. THAT would be bullish for the energy stocks as well.

Of course, we don’t want to get ahead of ourselves. We don’t want to jump the gun, but this is another item we’ll be watching very closely as we move through the rest of January. There are some investors who are skeptical when it comes to thinking that the energy stocks can outperform again in 2023. Well, if WTI can break above its first key resistance level at some point in the next week or two, the odds that the group will continue to outperform should rise quite nicely. (Chart on crude below.)

Finally, it was sad to hear that David Crosby passed away this week. When I was a very young teenager, one album that was played at every party I went to was “Déjà Vu” by Crosby, Stills, Nash and Young. It was released when me and my friends were still in elementary school, but it was still a VERY popular one by the time we came of age. (This was especially true for the girls…and if THEY loved it, WE loved it! ……Of course, David Crosby was not just a member of CSN. He was also a member of the iconic band, The Byrds, in the mid/late 60s as well.

If you’re ever go to the beach for a relaxing sunset picnic with your significant other…or your family…or even just your friends, bring along something that will enable you to listen to Déjà Vu to as the sun is setting. It will help make the evening a magical one. It’s an absolute classic.

Matthew J. Maley

Founder, The Maley Report

TheMaleyReport.com

matthewjmaley@gmail.com

Although the information contained in this report (not including disclosures contained herein) has been obtained from sources we believe to be reliable, the accuracy and completeness of such information and the opinions expressed herein cannot be guaranteed. This report is for informational purposes only and under no circumstances is it to be construed as an offer to sell, or a solicitation to buy, any security. Any recommendation contained in this report may not be appropriate for all investors. Trading options is not suitable for all investors and may involve risk of loss. Additional information is available upon request.