Key Turning Point For The Markets

The action in the stock market yesterday is one of three developments this week which has raised the odds significantly that the stock market now stands at a key turning point.

When you look at the numbers at the end of trading yesterday, it did not seem like it was anything special. Yes, the Nasdaq did decline by 1% and the S&P 500 fell by almost that much, but that’s something we’ve seen on several trading days so far this year. No market moves in a straight line…and this year’s nice rally has seen its share of down-days. When you looked at the “internals” at the end of the day, nothing really stood out either. The volume was slightly higher than Wednesday’s, but it was nothing more that average compared to what we’ve so far in 2023. As for the breadth, it was 3 to 1 negative for the S&P 500, so that wasn’t overwhelming bad…and it was less than 2 to 1 negative for the NDX 100! Therefore, even though all of these “final numbers” were poor, that weren’t horrible by any stretch of the imagination.

However, yesterday’s action was still a big concern for us. First of all, even though the breadth was not horrible, it was A LOT worse than where it was in the morning. The breadth (advancers vs. decliners) was 10 to 1 to the positive side on both indices in early trading…so you can see that the breadth did deteriorate dramatically as we moved through the day. Also, this was the first day since December where the stock market did not see any kind of material bounce during its decline. We’ve had several “down days” during the nice rally we’ve seen so far this year…and we’ve even had some declines that involved intraday reversals (like we saw yesterday)…but all of those involved some pretty big intraday bounces during their declines. However, yesterday’s bounces were all quite feeble.

This is the kind of action that tells us that the buyers are getting exhausted. It seems to be signaling to investors that the stock market is having a tougher time looking past the poor earnings/guidance they’ve received during this earnings season. In our minds, it’s not a big surprise that this week is the one where investors are waking up to the earnings situation…given that interest rates are bouncing back in a material way…….It’s one thing to try to look past poor earnings for a while, but that is a lot harder to do when interest rates stop falling.

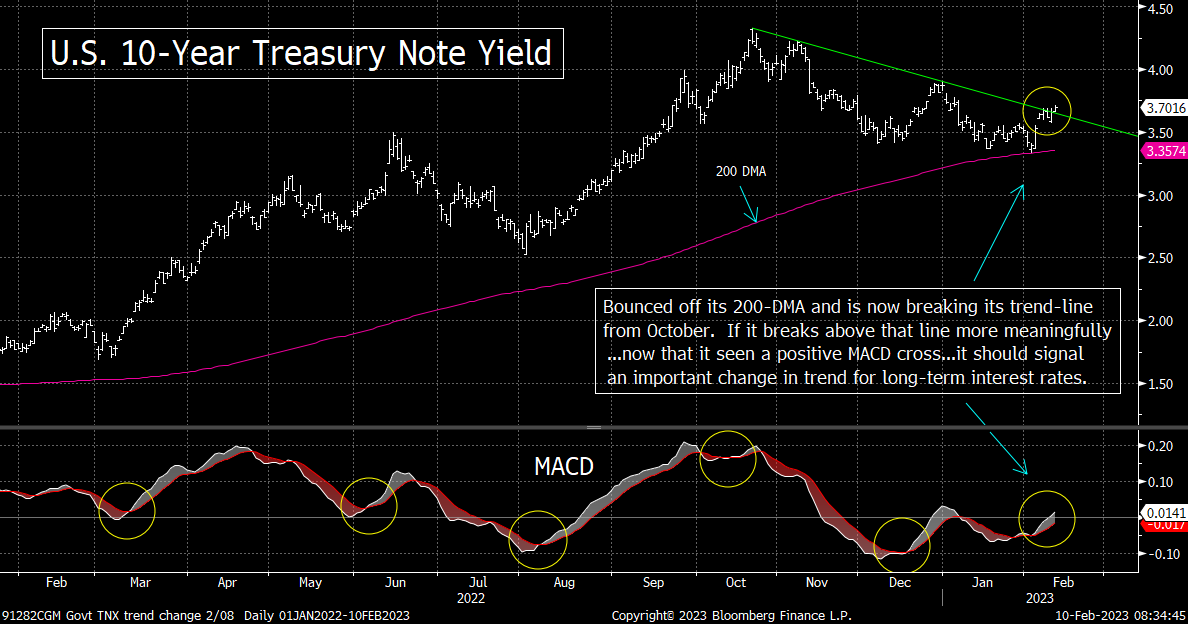

Speaking of intraday reversals, the Treasury market had its own reversal yesterday. After trading as low as 3.57% in the morning (and testing its 50-DMA), the yield on the 10yr Treasury note bounced strongly…and closed at 3.67% by the end of the day. That yield is trading even higher this morning…above 3.7%. So, as you can see, it has broken even further above its trend-line from October (that we talked about earlier this week.) The yield on the U.S. 2yr note is also trading higher…and is now back above 4.5%...after trading as low as 4.03% just one week ago! So, as you can see, the interest rate environment has changed quite a bit over the past week. Therefore, the fact that yesterday’s action in the stock market was particularly concerning should not be a big surprise.

We will still have to see a bit more downside follow-through before we can confirm a change in trend for the stock market, but we won’t need as much downside follow-through as many people might think. The MACD chart is curling over and is getting close to a negative cross on the S&P 500. As you can see from the S&P 500 chart below, negative crosses have been followed by some very serious (further) declines over the past year, so if we do indeed get one, it’s going to raise an important warning flag on the stock market.

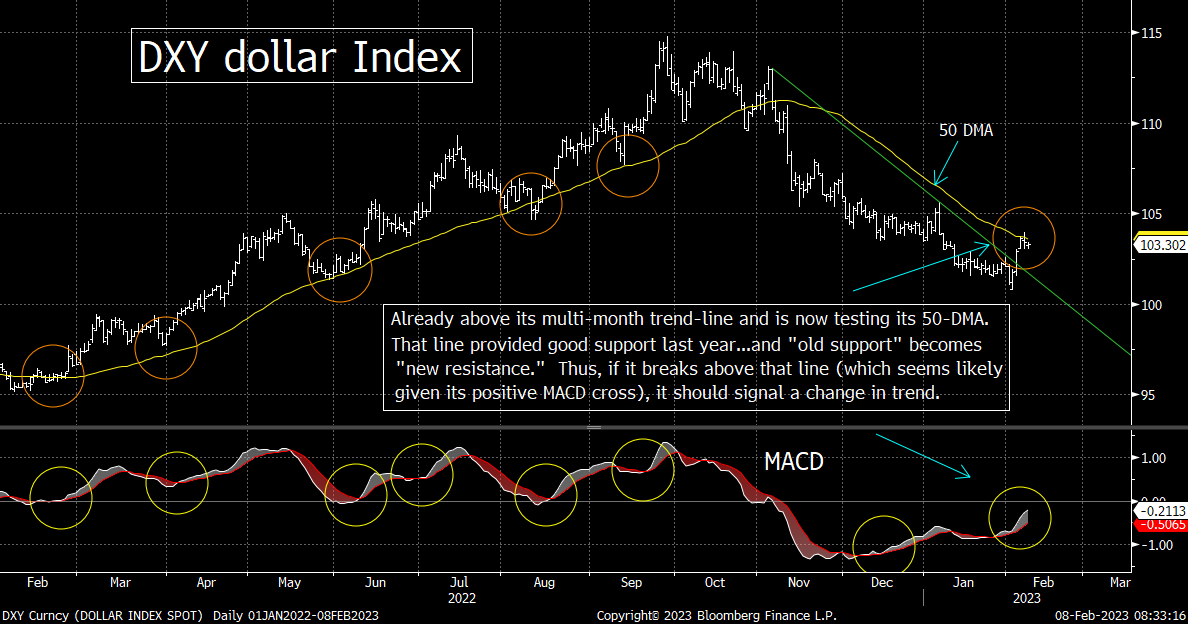

On top of all this, we’d also note that the DXY dollar index has tested its 50-DMA every single day this week. So if it can finally break above that line…either today, or sometimes next week…it could/should have some negative implications for the stock and bond markets as well………What we’re saying is that although the decline in the stock market so far this week might seem quite benign, yesterday’s action just might be telling us that we’re looking at an extremely important turning point for stocks…especially since we’ve already seen some important moves in the fixed income and currency markets!

Matthew J. Maley

Founder, The Maley Report

TheMaleyReport.com

matthewjmaley@gmail.com

Although the information contained in this report (not including disclosures contained herein) has been obtained from sources we believe to be reliable, the accuracy and completeness of such information and the opinions expressed herein cannot be guaranteed. This report is for informational purposes only and under no circumstances is it to be construed as an offer to sell, or a solicitation to buy, any security. Any recommendation contained in this report may not be appropriate for all investors. Trading options is not suitable for all investors and may involve risk of loss. Additional information is available upon request.