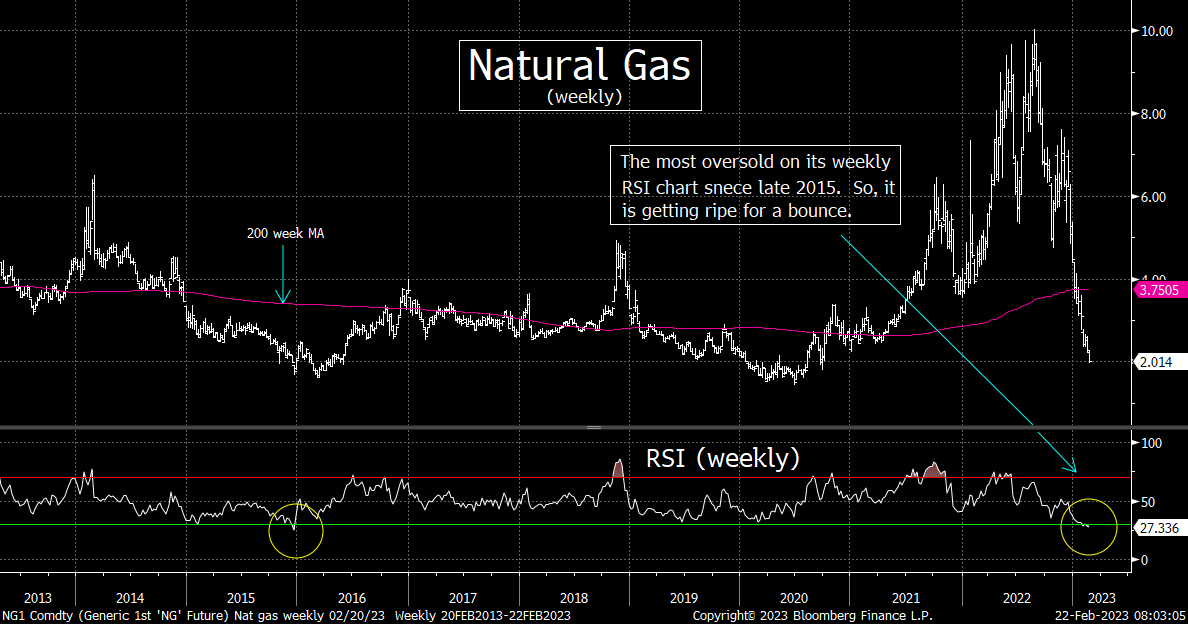

Natural Gas Is (Finally) Getting Ripe for a Tradable Bounce

The stock market "internals" and "late day action" have changed...and are becoming a concern.....Also, natural gas has become very oversold on its charts, so it's getting ripe for a bounce that lasts for more than just a few days.

- Rough day for the stock market yesterday…and the “internals” were quite poor.

- The sudden change in “late day action” in the stock market is becoming a bit of a concern.

- Natural gas is getting very oversold on its charts…and is thus becoming ripe for a bounce.

The decline in the stock market yesterday gave us the worst single day for stocks since the 1929 crash….Okay, okay, it wasn’t quite THAT bad. However, given how great the stock market has acted until very recently this year, yesterday did feel like it was one of the worst days in a very long time. In other words, there is no question that it was not a good day, but we’ve certainly had worse ones over the past 12-14 months.

What made the decline seem so bad was not so much the final tallies. The S&P 500 fell 2% and the NDX 100 decline 2.4%, but what made things seem much worse was the fact that the market did not try to bounce at all yesterday. We’ve only had two other days when the market has moved steadily lower throughout the day this year without any kind of measurable bounce. However, those two days (Jan 18 and Feb 9) were days when the market opened nicely higher…only to roll-over after the opening. Yesterday, the market opened lower…and just kept on going. This was a big change from what we’ve seen so far this year…when even the down days had a few sharp rallies in the middle of them.

The internals were quite bad, however. The breadth (the advancers vs. the decliners) was 7.6 to 1 negative for the S&P 500 Index…and a whopping 24 to 1 negative for NDX Nasdaq 100 Index. The volume did not increase yesterday, but given that it was a Tuesday after a long weekend…which usually has very low volume…the fact that the composite volume was in-line with the average level we’ve seen so far this year, it shows that there was indeed a decent amount of selling pressure during yesterday’s sizeable decline.

The futures are trading a bit higher this morning…as Treasury yields are trading a bit lower this morning and a couple of earnings reports have come in better-than-expected (like Palo Alto Networks and TJ Max). On top of this, the dollar is trading slightly lower…and St. Louis Fed President Bullard has said that he thinks the markets overpriced a recession at the end of 2022. So, there are a few reasons why the stock market is getting some relief this morning. This afternoon, we get the minutes from the Fed’s last meeting, so that could have an impact several hours from now. (We also get the earnings on Nvidia that we highlighted yesterday, but those don’t come out until after the close of trading.)

Away from the stock market, 2023 has been a very good year for several different asset classes. However, it has been an absolutely HORRIBLE year for natural gas. This commodity is down 25% year-to-date. In fact, it has collapsed almost 80% since August! Thus, the debacle in natural gas is not just a 2023 phenomenon…it has been going on for six months! Warm weather in both Europe and the U.S. has a lot to due with this decline in nat gas prices. Yes, much of the country is about to get hit pretty hard with some tough winter weather, but that’s not necessarily a reason to think these nat gas prices will see a bounce.

HOWEVER, we do need to point out that natural gas is becoming quite oversold. Looking at its weekly RSI chart, it has become the most oversold it has been since late 2015! It’s no surprise that the same can be said for the UNG natural gas ETF…and the 2x leverage ETF for nat gas (BOIL) is also quite oversold…..Of course, any asset can stay oversold for an extended period of time. However, with natural gas having trading below $2 for a NY minute this morning, it does seem to us that it is finally reaching the kind of oversold condition that makes it quite ripe for the kind of bounce that will last for more than just a few days. Therefore, those who are short this commodity should be careful…at least over the near term…and buyers might want to think about nibbling down at these prices. (Chart below.)

Back to the stock market, we want to go back to something we highlighted at the beginning of this morning’s piece. For only the third time this year, the stock market did not see any kind of a material bounce during yesterday’s decline. It’s only the third time this year, but it’s the second time in less than two weeks. It’s also the second time in just three days that the market has closed on its lows for the day. This might not be enough to raise some serious concerns just yet. However, there is little question that the stock market has acted extremely well in the afternoon on most trading days this year…BUT this is staring to change. Therefore, if this kind of disappointing “late-day action” continues in the days and weeks ahead, it should certainly raise some concerns for investors.

Matthew J. Maley

Founder, The Maley Report

TheMaleyReport.com

matthewjmaley@gmail.com

Although the information contained in this report (not including disclosures contained herein) has been obtained from sources we believe to be reliable, the accuracy and completeness of such information and the opinions expressed herein cannot be guaranteed. This report is for informational purposes only and under no circumstances is it to be construed as an offer to sell, or a solicitation to buy, any security. Any recommendation contained in this report may not be appropriate for all investors. Trading options is not suitable for all investors and may involve risk of loss. Additional information is available upon request.